State Incentives

FUNDS AWARDED DEPEND ON

• Level of development of municipality

• Number of people employed

• Level of salaries

• Amount of funds invested

• Size of the company

• Up to 7,000 EUR per job created

LOCAL GOVERNMENT INCENTIVES

• Reduction or exemption of payment of certain local fees or charges

• Benefits for construction or lease of necessary facilities for investment

• Benefits for connecting to local infrastructure

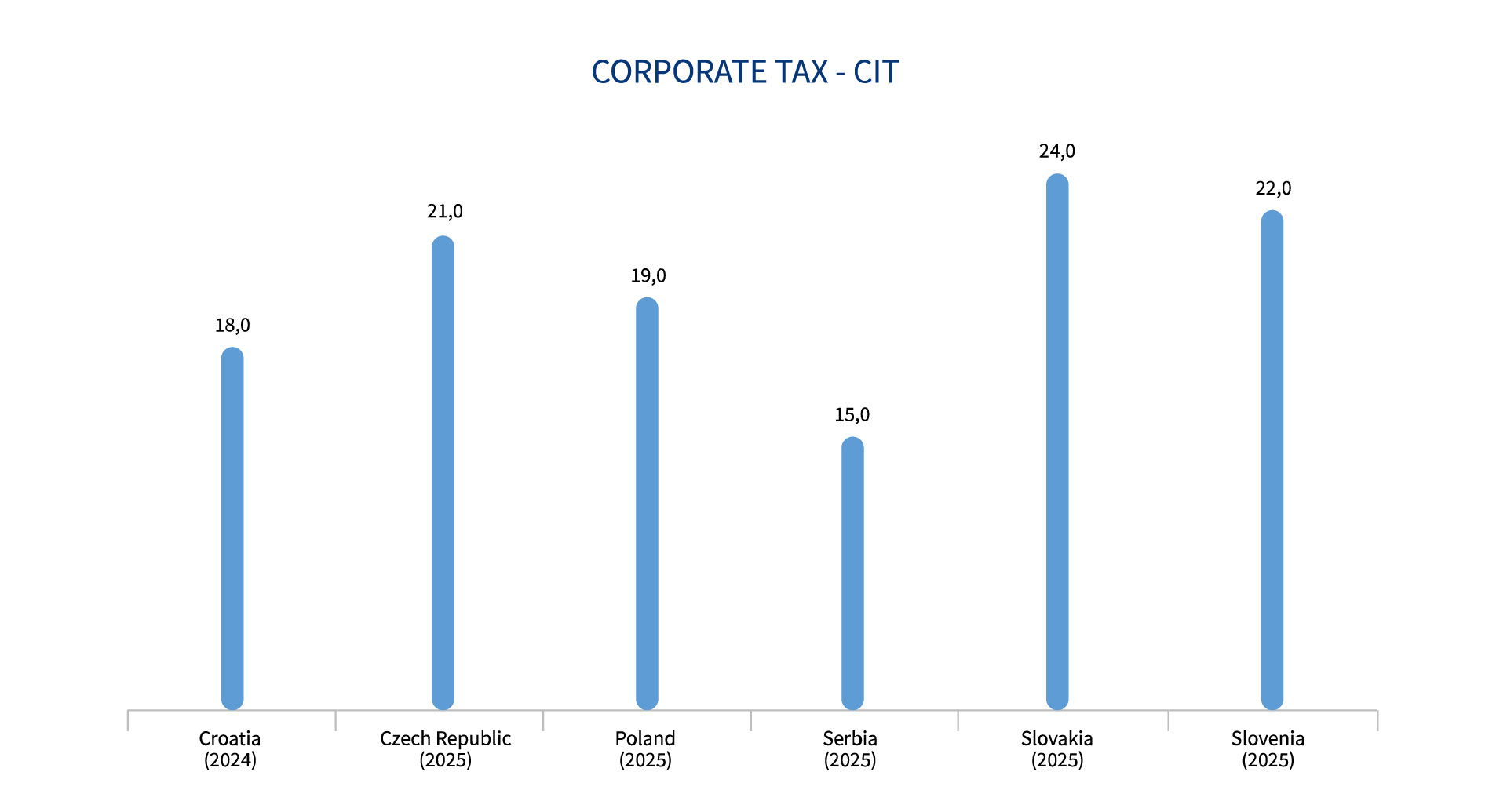

TAX INCENTIVES

• Available Corporate Tax holiday for 10 years for certain investments

• Treaties on avoiding double taxation with 61 states

• Tax statement losses may be transferred to the account of the profit declared in the tax statement in future accounting periods (for up to 5 years)

• Partial compensation of taxes and social contributions paid on salaries for employing unemployed persons